President Aquino says they've awarded more PPP projects than the past 3 administrations

MANILA, Philippines – The Aquino administration has awarded 7 public-private partnership projects (PPPs) versus the 6 solicited PPPs implemented by the previous 3 administrations.

President Benigno Aquino III boasted of this accomplishment in his 5th State of the Nation Address on Monday, July 28.

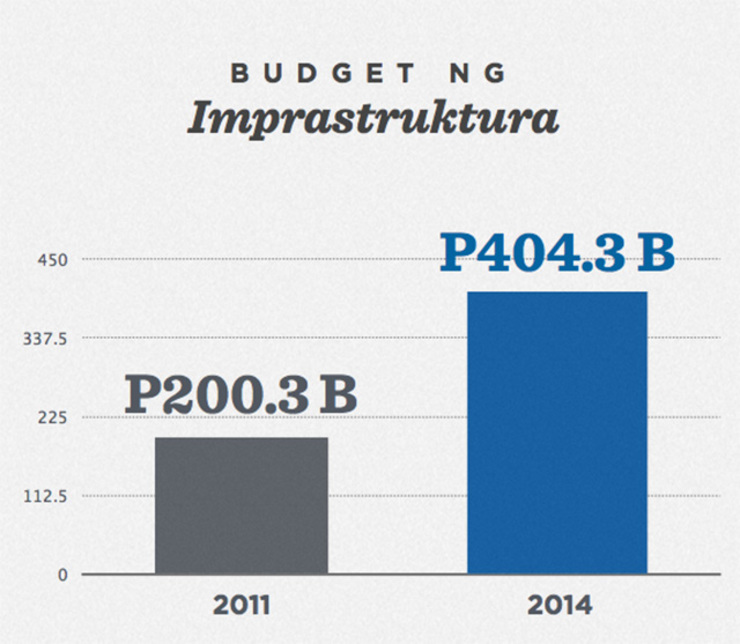

He stressed that sound infrastructure is needed for the Philippine economy to continue moving forward, be more competitive, accelerate the flow of goods and services, and attract attract more investors.

Image from https://twitter.com/govph

He said such increase did not require hike in taxes, except for the Sin Tax Reform Law.

7 PPP projects awarded

To date, the Aquino administration has awarded

7 PPP projects worth about P62.6 billion ($1.44 billion). These include:

The bidding for the most expensive PPP project to date – the National Economic and Development Authority (NEDA) Board-approved, P123-billion ($2.84 billion)

Laguna Lakeshore Expressway Dike – will also be opened before 2014 ends. The

project will be bid out under the Build-Operate-Transfer and is expected to reduce traffic and flooding in southern Metro Manila and Laguna with the construction of a 47-kilometer flood control dike on top of a 6-lane expressway.

There are more companies now willing to invest in the country through the PPP program, easing the burden on government expenditures, Aquino said.

He attributed this interest in shortened application procedures and decreasing opportunities for bribery in project biddings.

He said the Department of Public Works and Highways (DPWH) saved P28 billion ($646 million) after hastening the implementation of projects.

More infra projects nearing completion

He said the government was also able to get good offers for the Mactan-Cebu International Airport expansion project worth P14 billion ($322.92 million), and the NAIA Expressway Project Phase 2 worth P11 billion ($253.63 million).

The Tarlac-Pangasinan Expressway project is now facilitating traffic from Tarlac to Rosales, Pangasinan. The Urdaneta portion is expected to be completed before 2014 ends, while the expressway will reach La Union by next year.

Projects that took decades to complete are now seeing completion, Aquino said. They include:

NEDA board-approved projects

Once the C-6 road connecting to San Jose Del Monte, Bulacan is finished, it is expected to decongest traffic in EDSA.

To address the water shortage in Metro Manila by 2021, the Aquino administration approved the Kaliwa Dam Project in General Nakar, Quezon, and the repair of the lines of Angat Dam. The Water District Development Sector Project, under the Local Water Utilities Administration, has also been approved.

Other NEDA board-approved projects in the pipeline include the Laoag City Bypass Link Road project, the Cebu Bus Rapid Transit project, and the Light Rail Transit (LRT) Line 1 South Extension and Line 2 East Extension projects.

The modern Clark Green City in Capas, Tarlac has also been approved. The project is expected to boost commerce in Central Luzon and the rest of the country. This once desolated vast piece of land is seen to be the next, if not better than, Bonifacio Global City, the President said.

“These are only of the few infrastructure projects that we have no plans to pass to the next administration as problems, instead, they are now started to being enjoyed by our bosses, the Filipino people,” Aquino stressed in Filipino. – With a report from Lynda C. Corpuz/Rappler.com